Year-end is usually the most significant key reporting date in the calendar. As with all key reporting dates, there are certain steps that can be taken to help prepare.

The area of most importance varies from company to company, however, depending on the company’s debt levels, year-end covenant forecasting might be the area in focus.

Covenant forecasting requires the forecasting of balance sheet numbers, notably cash levels, into year-end. This can be a challenging task because these numbers are a snapshot in time and are therefore subject to more volatility as the key date approaches.

What are the challenges of covenant forecasting?

One of the most challenging elements of covenant forecasting is collating the vast array of data required to feed into the forecasting process. Below we review the sources of this data, before outlining the steps you can take to make the process easier.

The two most common debt covenants are:

- Leverage ratio. This provides a good snapshot of the risk levels of the company and is calculated by diving net debt by earnings.

- Interest covenant ratio. This is used to determine how easily a company can pay their interest expense on outstanding debt and is calculated by dividing the company’s earnings by the total cost of their interest expenses for the same period.

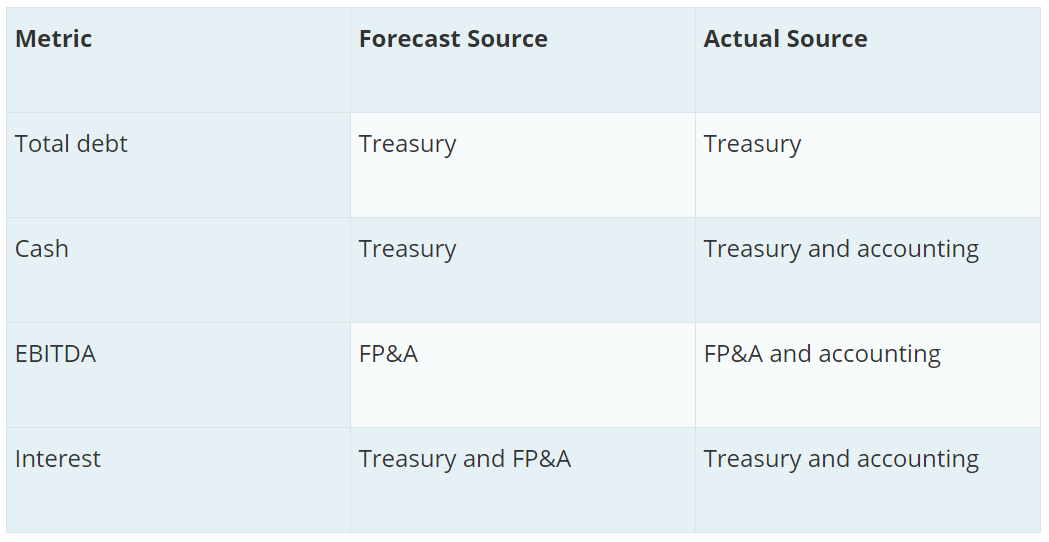

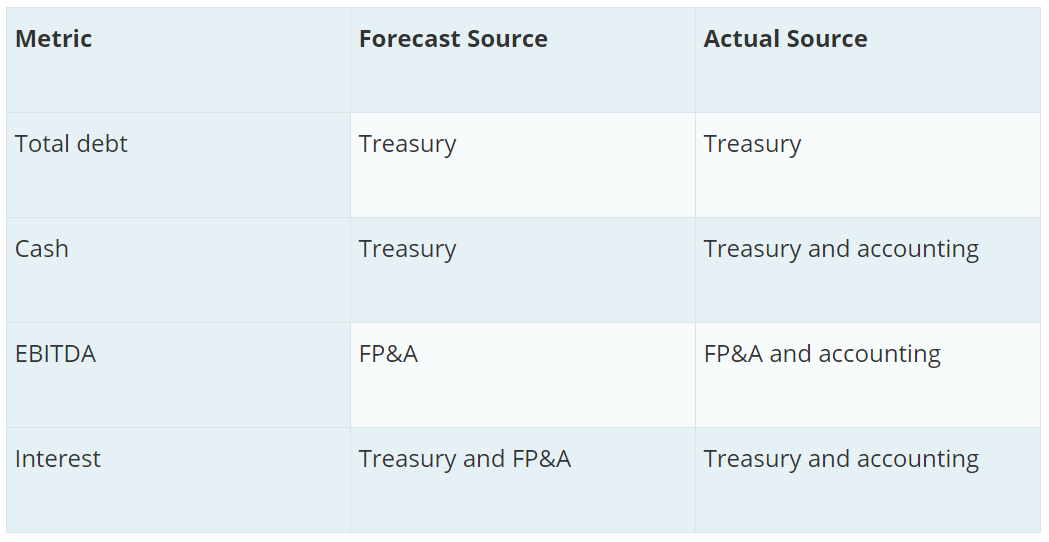

The table below shows the departments from whom the data is sourced when calculating these debt covenants.

As the table shows, for a number of inputs, the sources of forecast and actual data are different, providing an added layer of complexity to the process. In addition, a lender may request an adjusted measure of EBITDA which removes particular business activities if they are considered to have a distorting effect on the underlying numbers.

How to prepare as year-end approaches

The most important preparatory measure to take is to communicate early and clearly with everyone who contributes data to the covenant forecasting process.

The treasurer or financial controller responsible for covenant forecasting will be depending on a huge number of people to input into the process. It is important to manage expectations for those people by letting them know what will be asked of them as early as possible as well as letting them know what their data is being used for. Letting people know what they’re contributing data to, and how important it is, can help to engage them with the process.

As year-end approaches, these people will also need to be prepared for the increased frequency of data requests. In most instances a daily data refresh (at minimum) is likely in the two weeks before year-end.

All eyes on covenant forecasting numbers

There are many external parties who closely monitor covenant levels, including:

Banks

For banks (and other lenders) covenant levels are a key measure of risk. Therefore, they will closely monitor covenants and look for guidance as key dates approach.

Rating agencies

Rating agencies (for example S&P and Moody’s) keep a very close eye on covenant levels and potential covenant breaches. In case of a default, a rating agency may issue a credit downgrade which can have a significant effect on a company’s financial health.

Equity markets

The severity of the impact a covenant breach can have on a company can have a corresponding impact on its share price. In the event of a covenant breach triggering a default, control of the business may be handed to lenders, thereby erasing most (or all) of the equity.

Evolving economic cycle

While the examples of defaults listed above are extreme scenarios, many large corporates are highly exposed to these risks at the moment due to the current environment of high corporate debt levels.

Any departure from the current accommodative central bank policy (such as an increase in interest rates or tightening of credit conditions) could cause a sizeable increase in the number of covenant breaches and defaults.

How to forecast the biggest variable in the process

The biggest variable in the covenant forecasting process? Cash.

While earnings and debt figures should be increasingly under control as year-end approaches, the precise snapshot cash closing figure can be hard to calculate because of the number of inputs into the figure.

The most effective way to forecast cash accurately (and quickly) is to use a well-designed process that leverages specialized cash forecasting software.

Consolidated cash figures

The first step in the process is an understanding of the total cash figure as it stands right now. For most large corporates this cash is spread across a range of locations and a multitude of different accounts. It is therefore impossible to get a “live” consolidated cash figure without the use of specialized bank and liquidity reporting software. Software will be able to pull all data from these accounts instantly and automatically from a range of sources (such as MT940 or BAI2 files).

Comparing and measuring cash movements

To understand where cash is likely to arrive at year-end it is useful to measure how it is currently trending. Measuring and analyzing recent and historic cash movements can help to inform the forecast of where cash is likely to close at the key date. The use of analytical tools can help to identify cyclical trends which should also be factored in to increase overall accuracy.

The above is an abridged version of a CashAnalytics article which outlines how to prepare covenant forecasts in advance of key reporting dates in more detail.

Upgrading your cash forecasting process

CashAnalytics recently produced a practical guide for anyone intending set up a new cash forecasting process. The guide is built on the experience CashAnalytics has in helping large, multinational organizations to automate their forecasting processes.

As a specialized cash flow software company, CashAnalytics has helped companies across a wide variety of industries, and has developed a thorough yet efficient set-up process that enables quick and easy integration. To download the pdf guide please click here.

www.cashanalytics.com