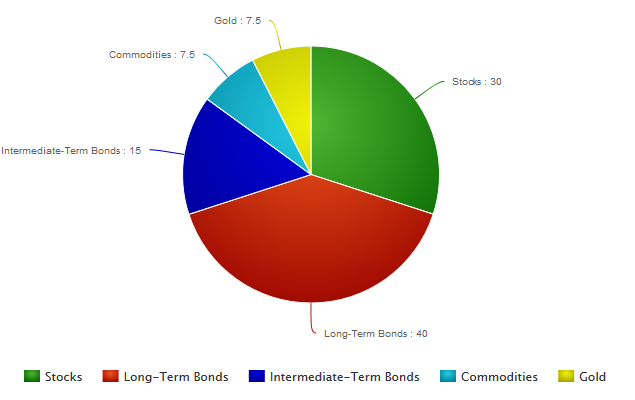

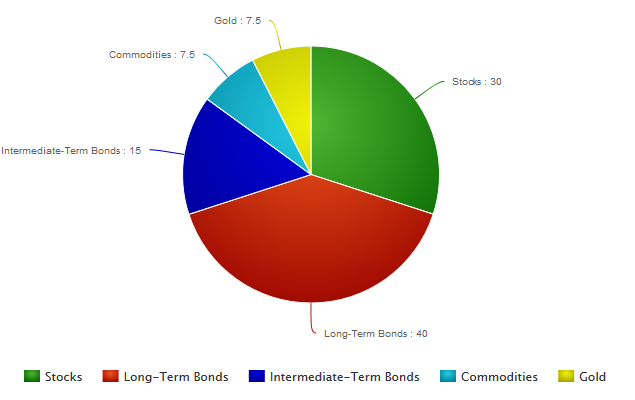

The founder of the largest hedge fund in the world, Bridgewater Associates, Ray Dalio developed the strategy for pension funds that is now called the All-Weather strategy. He recently said that he will also put money for his family into a fund, which invests according to the All-Weather strategy. What is the All-Weather strategy about? The All-Weather maximizes diversification, minimizes volatility and enhances performance. It consists of:

- 7.5% Gold;

- 7.5% Commodities;

- 15% Intermediate-Term Bonds;

- 40% Long-Term Bonds; and only

- 30% Stocks

The high allocation of bonds in the All-Weather portfolio might surprise but the reason is the balancing of risk. Table 1 (below) shows the return and volatility of different asset classes from 1994 to 2017. Stocks show the highest return but also their volatility is double than bond volatility. Long-Term Bonds show the best performance after stocks in the analyzed period. The volatility of Long-Term Bonds is the same as Intermediate-Term Bonds and the correlation coefficient with stocks is almost zero. Portfolio that combines stocks with long term bonds can achieve much better return for the same amount of risk. Intermediate Bonds have even negative correlation with stocks.

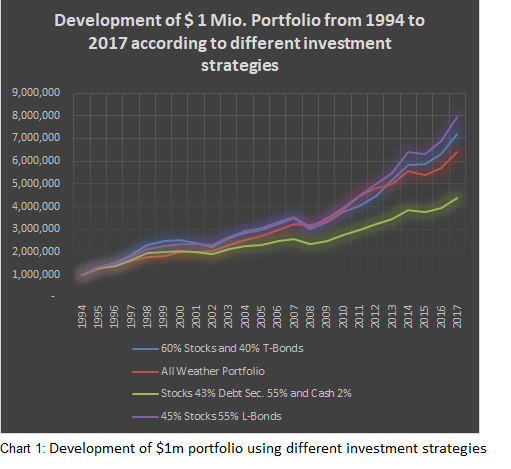

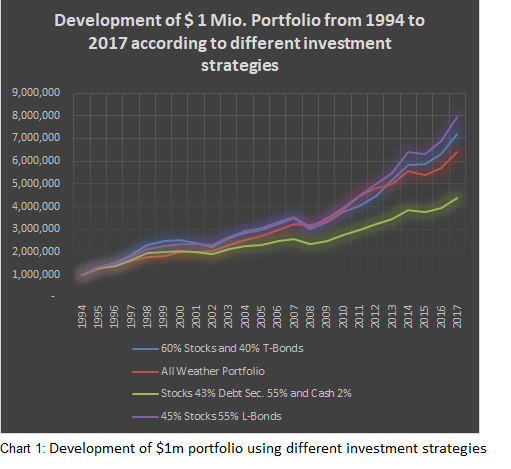

However, the two other asset classes Precious Metals and Commodities barely contribute to the return of the portfolio and show very high volatility. Their correlation coefficients with stocks are negative so they have positive diversification effects but reduce the overall performance substantially. If they would be substituted for out of the money call options on gold and commodities the performance would be better and would provide hedge for the situation when high unexpected inflation would occur. I back-tested four different investment strategies:

- the common 60% stocks and 40% T-Bonds

- the All-Weather Portfolio

- 43% stocks, 55% T-Bonds and L-Bonds, T-Bills 2%

- 45% stocks and 55% L-Bonds

In the past the 60% stocks and 40% T-Bonds investment strategy was the most common strategy among pension fund investment managers. In order to reduce the volatility of the investment portfolio, which is very crucial for pension funds to avoid any underfunding, the asset allocation in 2018 in USA is more like 50% stocks and 21% bonds, 1% cash and 28% other investments – private equity, real estate etc.

One should keep in mind that other investment solutions have substantially higher transactions costs than investment in bonds or in equity and are almost worthless when have to be sold under fire. P&G according to their Annual Report has a desired asset allocation of 43% stocks, 55% T-Bonds and L-Bonds, 2% cash. In our analysis T-Bonds are treasuries with a maturity of up to 10 years and L-Bonds represent treasuries with maturities of up to 30 years. P&G states only that they invest 55% in debt securities, therefore here the composition of T-Bonds and L-Bonds does not represent the composition in the P&G portfolio and results are different.

I start every year from 1994 to 2017 with the desired asset allocation as per each strategy. At the end of each year asset allocation changes according to market data and the desired allocation has to be achieved again. This is done only once a year, transaction costs and taxes are not taken into account. Table 2 and chart 1 show the results of the back-testing. $1m invested in 1994 grow to more than $7.2m in 2017 when invested in 60% equity and 40% bonds. The highest growth can be achieved with a portfolio of 45% equity and 55% long term treasury bonds. However for pension investment managers volatility is a very big concern. Here comes All Weather strategy into play. The results are not as good as the other two strategies but $1m grow from 1994 to 2017 to $6.4m. It shows the lowest volatility and the highest sharp ratio. All Weather portfolio has an annual return 0.82% lower than 60/40 portfolio but its volatility per year is 3.32% lower.

For pension fund investment managers the All-Weather portfolio is a better risk adjusted return relative to the investment risk. Pension fund managers must take into account the variability of the portfolio returns from one year to another and here is the All-Weather portfolio superior.

We can easily analyze the past but we cannot predict the future. If we could just extrapolate the past the portfolio of 45% stocks and 55% L-Bonds should be a preferable one. However after a very long period of extremely low interest rates a portfolio consisting of 55% of treasuries with maturities up to 30 years may have quite low returns when long-term interests continue rising. Therefore in the near future the old traditional 60/40 portfolio might be the best bet after all.

Volatility is not only a risk. It represents also a chance. It is a chance that the return would be substantially higher than the expected return according to the average return. If somebody can bear the risk, he or she can see the higher volatility as the possibility to increase return. A private investor with a long term time horizon or hedge fund manager can accept volatility to increase the future returns. According to Table 3 (below) there are substantial return differences when we accept higher volatility. Portfolios consisting of 100% equities have the highest potential returns. Long term investors who can accept volatility as a chance and not as a risk can substantially increase returns when they invest mostly in equities.

The All-Weather Strategy might not be the best strategy for private investors with a long term horizon. Investment in stocks has proven to be the most successful investment for at least the last 200 years. The best investment strategy for pension fund managers is not necessarily the best strategy for everybody because of different attitudes towards risk. Investing in individual stocks or sectors for long time without a frequent review might also be quite risky. In 1900 railroads were the most important sector accounting to more than 50% of US or UK equity market capitalization. In 2000 their market share was minuscule. The information technology sector which was absent in 1900 amounted to almost 30% in 2000. We do not know which sector or which national market will be most important in 2100. However the correctly diversified portfolio will prosper for eternity.

About the author

Walter Ochynski has more than 25 years of financial experience. He worked for international banks and multinational corporation gathering experience in P&L/risk management, M&A, investment strategies, negotiation, cash/currency management and cost control. He was assistant treasurer of Gillette and is author of books about cash and currency management and application of computer in financial management.