The latest Treasury Diagnostics report from Citi has revealed a disconnect between the recognition that technology is an important enabler to meet risk management objectives and the reality of actually utilizing technology.

Citi’s global corporate benchmarking survey is designed to help companies assess their treasury, working capital, and risk management practices. Titled Managing Risk and Opportunity through Uncertainty, the report highlights key focus areas for corporate treasurers against the backdrop of an increasingly complex environment.

Respondents shared their views and methodologies pertaining to operational and financial risk management processes, as well as technology. With participation by 400 large companies from a diverse range of industries and geographies, the report highlights that robust risk management remains a priority for corporate treasurers.

Treasury Technology

Around half of the survey’s participants reported that their treasury management system does not fully support financial risk management processes. Many companies need to make material changes to optimize their treasury and financial technology core infrastructure, with the majority identifying cost and integration of technologies as the biggest challenges to overcome.

Key highlights around technology include:

- 63% noted that their treasury management system (TMS) was either not integrated or only partially integrated with their Enterprise Resource Planning (ERP), which provides the required underlying business data to identify risk exposures.

- 45% highlighted that their TMS did not support financial risk management processes, thereby creating greater complexity and potential for error.

- 77% reported that they lack full integration of their ERP and TMS infrastructure with banks, creating additional manual processes.

- Respondents are starting to embrace new technologies for efficiency and integration, with 58% leveraging Robotic Process Automation (RPA) and 54% using Application Programming Interfaces (APIs).

Looking ahead, 54% of respondents would like to see continuous improvement in operational treasury efficiency, with 77% expecting technology advances to drive fundamental changes in the treasury function. Companies are looking to banks as key partners in their journey to transform treasury, with 79% of respondents highlighting intent to acquire innovative solutions from banks to this end.

“As corporates increasingly recognize technology as an important enabler to meeting risk management objectives, they are searching for ways to effectively integrate their ecosystem and, while doing so, automate repetitive tasks,” Duncan Cole, EMEA Head of Treasury Advisory Group at Citi said. “Trusted partners with long-standing relationships are well placed to provide critical support and help corporates navigate the rapidly changing landscape.”

Financial risk management

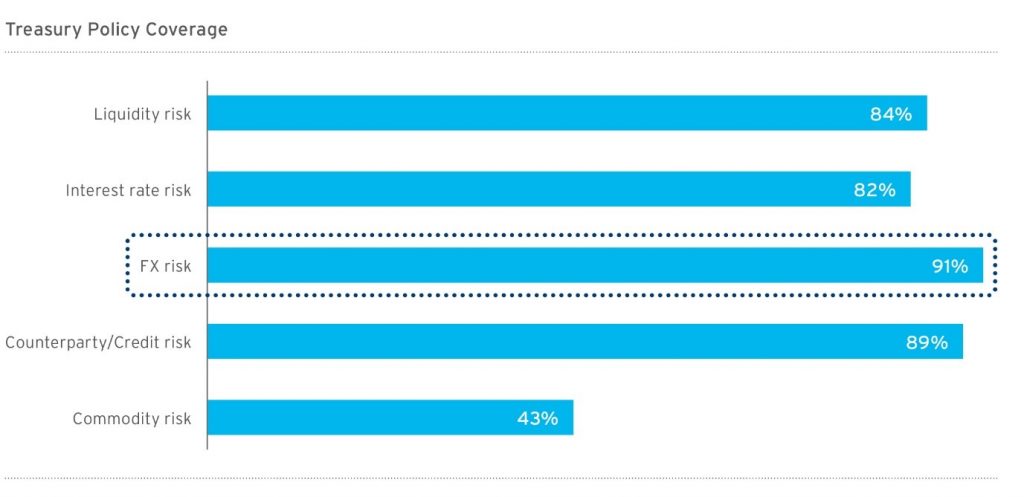

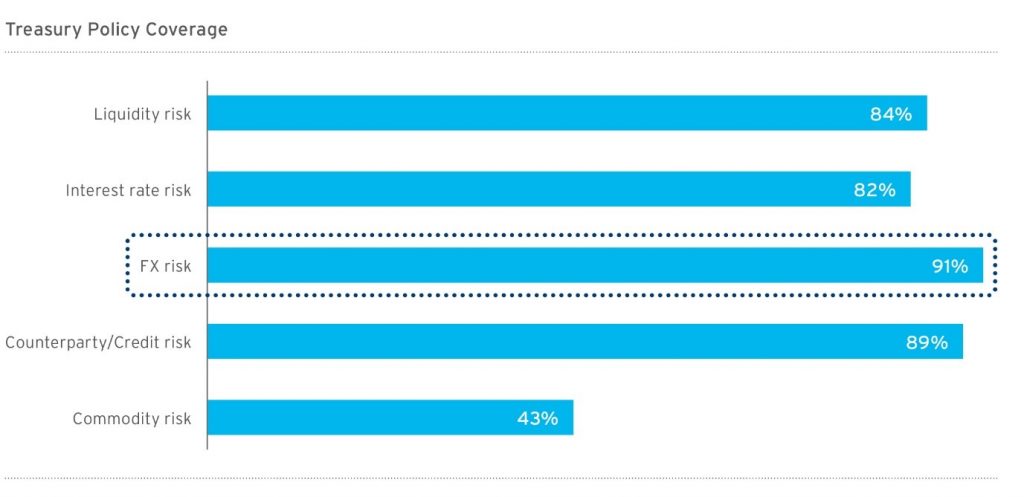

As cited earlier, around half of participants reported that their treasury management system does not fully support financial risk management processes, highlighting the need for a robust FX policy framework. However, 91% of respondents reported having a formal written policy in place, with 71% also indicating annual review. This evidences growing recognition by senior management that a holistic approach is required, given the need to integrate all forms of risk originating from the business.

Survey participants identified earnings as the main focus area for risk management objectives. Surprisingly, while 63% of companies flagged the reduction of earnings volatility as a key risk management objective, the proportion that actually directly hedge earnings translation exposures is quite low, at 12%.

Emerging Market Currency Risk is another area of concern for corporates: 82% of respondents reported having exposures to currencies outside the G10 and highlighted cost, lack of liquidity and local regulation as key challenges. Remarkably, 78% of respondents do not differentiate between emerging market and developed market hedging practices.

“In a market marked by low volatility and high geopolitical uncertainties, there is an opportunity for corporates to take a step back and use informed data and analytics to optimize currency risk,” Erik Johnson, Global Coordinator CitiFX Risk Solutions at Citi said. “This implies the use of more sophisticated tools and the implementation of differentiated strategies between emerging and developed markets”.

Operational risk management

The large majority (80%) of companies surveyed manage risk on a centralized basis. As a construct for centralizing currency and liquidity risk, the in-house bank has now been adopted by 55% of those surveyed. However, some core risk management techniques appear to have been underutilized. For example, only 48% of respondents are utilizing an intercompany netting process. For operational and back office processes, 72% of respondents utilize Shared Service Centers.

The role of treasury in working capital management is growing, with over 80% of respondents noting treasury’s involvement in some capacity. However, less than a third of respondents cited treasurers as being fully accountable for company-wide working capital practices.

Top priorities

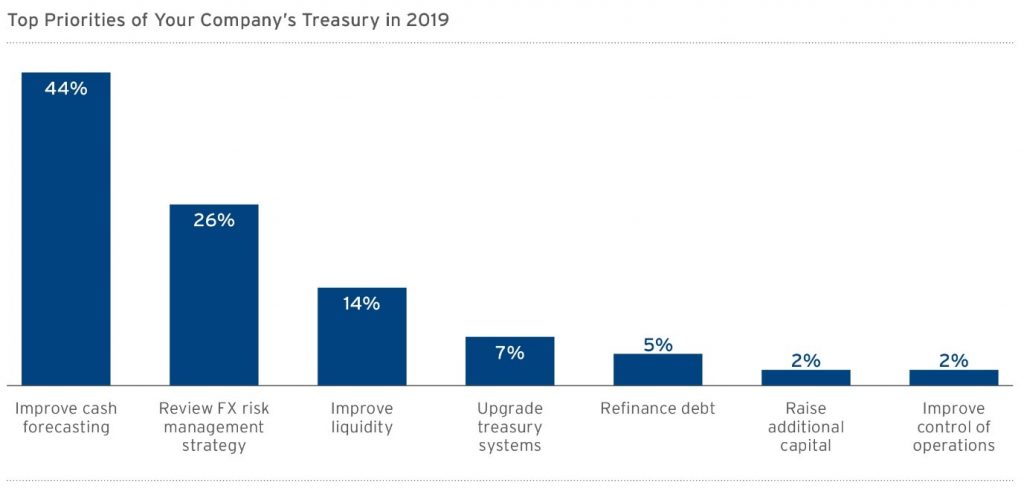

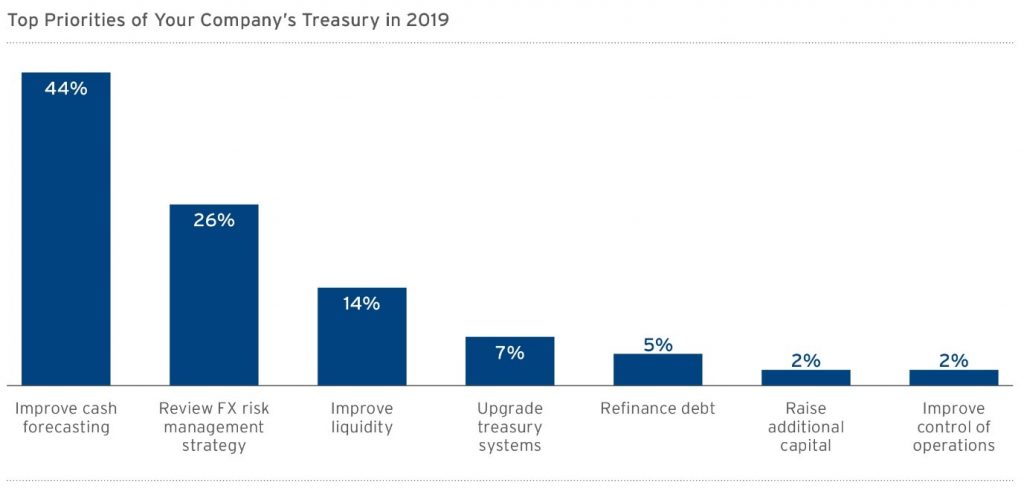

Liquidity forecasting continues to be a major focus area for corporates in 2019 and was the top priority identified for 44% of respondents.

To this end, 91% of participants have implemented cash flow forecasting methodologies to improve visibility into future multi-currency cash positions — thereby identifying natural offsets, and opportunities for more effective liquidity and currency risk management. However, given the opportunities that new technologies can provide, it is surprising that 72% of survey respondents reported manual inputs as part of their forecasting process.

Ron Chakravarti, global head of Treasury Advisory Group at Citi commented: “Against an uncertain global environment, corporate treasurers face many challenges around visibility, efficiency, and controls. However, the industry is now at a tipping point. Emerging technology and solutions are accelerating the centralization and digitization of treasury, presenting a huge opportunity for the treasury function to reinvent itself successfully and navigate the changing landscape.”