Investment in people to match technology, HSBC survey finds

By upskilling people and adopting innovative technologies, the end goal for businesses is to become more efficient, more customer-centric and greener.

By upskilling people and adopting innovative technologies, the end goal for businesses is to become more efficient, more customer-centric and greener.

According to a report published last month by HSBC, firms are now prioritizing investment in the wellbeing and future skills of their people, at the same time as technologies like robotics top their spending plans.

The Navigator: Made for the Future survey of over 2,500 companies in 14 countries and territories, discovered that 34% of decision-makers think their technological focus will ‘totally’ change over the coming 24 months, with a further 45% expecting ‘slight’ change. What’s more, over half (55%) plan to invest more in research and development in order to drive productivity.

When it comes to technological changes, treasury departments are expected to witness just as much change. Crucially, however, alongside the increased spending on technology, 52% will boost spending on skills training – ahead of employee wellbeing (43%), logistics (42%), plants or equipment (34%) and ‘bricks and mortar’ premises (29%).

Noel Quinn, CEO of HSBC Global Commercial Banking, said: “Excitement about rapidly-evolving technologies, including artificial intelligence (AI) and virtual reality, comes through clearly as businesses prepare to meet the needs of tomorrow’s customers. What this survey also shows is that the future is no dystopian nightmare. A business may need fewer people than today, but it will need those people to be highly trained and highly engaged – to be healthy and happy in their jobs – or they’ll take their skills elsewhere. Wellbeing and sustainability are becoming watchwords for business success.”

By upskilling employees and adopting innovative technologies, the end goal for businesses is to become more efficient, more customer-centric and greener. Over half the companies surveyed plan to increase their investment in customer experience (52%) and 45% will raise spending to become more environmentally sustainable over the next two years. Almost a quarter (24%) want to become greener to attract and retain talented staff, and 30% are feeling pressure from customers to improve in this area.

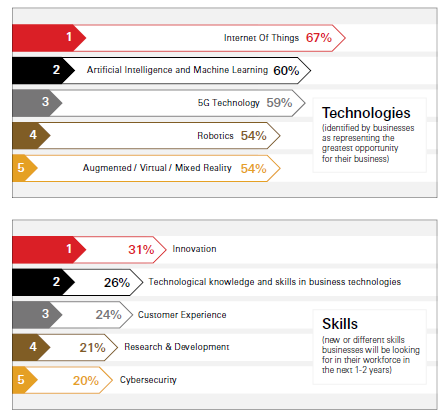

A number of new technologies have already been embraced by businesses and include AI (41%), the Internet of Things (40%), wearables (37%) and facial/image recognition (38%). The biggest benefits of employing these four technologies are improvements in productivity, customer experience and product or service quality.

While 76% of companies think technologies will make their staff more productive and 72% think they will enhance wellbeing, 59% also said they think they’ll need fewer workers in the future. Three in five (60%) intend to introduce or increase flexible working practices to enhance wellbeing and adapt to a rebalancing between human and automated output.

Interviews for the Navigator: Made for the Future survey were conducted in Australia, Canada, mainland China, France, Germany, Hong Kong, India, Indonesia, Malaysia, Mexico, Singapore, the UAE, the UK and the USA in May 2019.