Blueprint for financial strategy part three: measuring value

In the third article in this series, Ben Walters discusses how firms can measure if the strategy they are pursuing is creating value.

In the third article in this series, Ben Walters discusses how firms can measure if the strategy they are pursuing is creating value.

The first article in this series, A blueprint for financial strategy, described how the finance community is being asked to become increasingly more strategic. In my experience however we often do not stop to question exactly what this means. We discussed strategy and risk in the second article, with the message that strategic choice should be analysed through a risk management framework just as other risks are.

This third installment focuses on value. Specifically, how can a firm measure whether the strategy it is pursuing is creating value, because being able to do so is an incredibly powerful tool, not just in support of the contribution finance can make to strategic choice, but in so many other critical areas that drive performance within the firm.

If you stop to think about it, being able to measure value creation in a straightforward manner is akin to the Holy Grail of finance.

As figure one illustrates, one of the greatest strategists of modern times, Sir Winston Churchill, firmly believed that strategy had to be measured to see if it was succeeding. Setting strategy in a risk management framework forces the reporting and feedback loop. However, to be truly insightful the objective of the strategy, to create value, needs to be the focus of this reporting. Tools for doing so are limited. It is not so much that traditional financial statements do not provide the data necessary to measure value, because they do. It is just that we as a finance community are not looking at this data in the right way. Yet.

For instance, it is universally accepted that the investing activities of the firm such as CAPEX and M&A are subject to the scrutiny of a discounted cashflow calculation. Yet firms’ do not subject their own performance to the same analysis: management accounts and performance targets are produced in regimented traditional profit and loss centric format. The core elements that contribute to value are cash flows and risk, yet these are both areas which financial statements as we traditionally prepare them pretty much ignore. The good news is that this does not mean value can not be measured from financial statements. It can quite easily, it simply means they need to be viewed through a different lens.

Finance should be about measuring value, not profit or loss

Imagine if your very first lesson in accountancy went something along the lines of this: “Welcome to the world of accounting. You are about to embark on a wonderful career in which you will be immersed in numbers and complex judgements. Financial information will become your lifeblood. But remember this one fundamental concept – the work that we do exists to create one thing: VALUE. The debits and credits, financial reporting standards, trial balances, accruals, fair value measurements, etc are done to contribute towards one thing and one thing only: measuring the value created by the business you work in. Finance supports strategy, and strategy, in the commercial sense, is the search for value. We as accountants measure value and direct strategy accordingly.”

Now I am placing a wager here on two things: firstly that no one at the start of their career received a pep talk along these lines, and secondly that if you had done, hopefully it would have put a fundamentally different perspective on what accounting exists to achieve. I hope it does this for you now. If so, then please feel free to feel slightly excited as we will now explore how value can be measured in a straightforward manner from the complex and moribund world of financial statements we have created for ourselves.

Cash really is king. In fact, let’s go a step further: incremental cash really is king. A lot of firms, especially those over a certain size, are like super tankers. They don’t change course very easily and the direction, a bit like the financial results, is largely influenced by decisions made in the past. Add in to those results the effects of inflation over time, the writing down of assets and the various non-cash adjustments that proliferate the accounting rule book and financial statements of any given firm can be more than part historic artefact. If you want to measure if a strategy is working in the here and now then look at incremental results, i.e. what is changing year on year.

Why are incremental cash results so important? Well, to be blunt they cut out an awful lot of the noise that gets included in a set of accounts. There’s virtually no impact from inflation, historic write-downs, impairments and provisions that can make returns on book capital appear stellar. But most importantly incremental results reflect the recent actions of management and of the strategy the firm is pursuing. The super tanker may take several years to turn, but incremental results show the course it is setting.

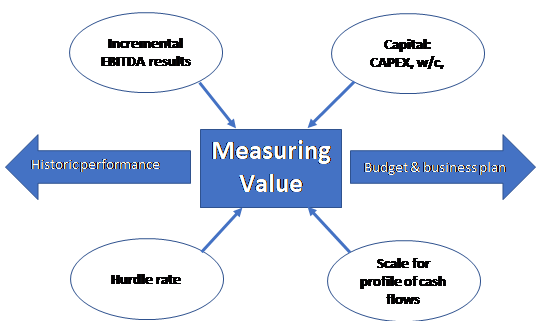

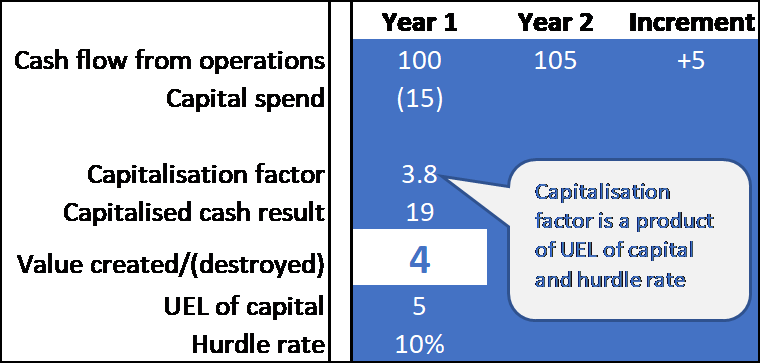

Figure 2 illustrates the inputs required in order to measure value. The incremental cash result from the business unit being measured, taken before capital spend, is capitalised by a factor dependent on the useful economic life of the capital invested and the firm’s target hurdle rate (an annuity factor). Capitalising the incremental cash result gives a snapshot of its present value and allows it to be compared to the most recent capital spend that has been deployed to create it.

Figure 3 explains this simple principle and having looked at it then you might be thinking to yourself, “is it really that simple?” Well, the answer is: yes, the principle really is that simple. It just requires us to analyse data that has always been in front of us in a different way. This technique is also extremely flexible. The flexibility lies in the fact it can be tailored to the profile of the cash returns and investing activities. It can be built into almost any reporting framework and it can be run across multiple business lines. The only constraints relate to the ability to stratify cash flow and capital data at the appropriate level.

When viewed across several years’ changes in strategic direction, longer term trends, and management can all be assessed as to whether they are creating or destroying value. Projecting the story forwards puts numbers around the strategic direction and management performance. It beats a budget or business plan because it is based on actual results.

The ability to measure value from readily recorded financial information is an extremely powerful tool. Strategy is about the search for and creation of value. The finance community can and should be at the fore front in measuring whether the strategy being pursued is shaping up to be successful or not. It puts the firm on the front foot by allowing it to project its current path forward and measure this against the capital being consumed and the returns required. The spotlight it shines on strategic choices offers powerful insight into directing the firm towards success.

Continuing the theme of value and performance measurement in the next article in this series we will explore business performance in a value-based context. We will discuss why this lens can offer such rich insight into the strategic direction of the firm and propel the finance function into the genuinely strategic role that today’s business environment demands.

The author, Ben Walters FCT, ACA is a practising corporate treasurer with a keen interest in the practical application of corporate finance in the real business environment. He believes finance can better support strategic analysis and enhance the overall value of the firm and has developed innovative thinking in this area. He is always keen to be contacted through [email protected]