Interest rate risk: identifying and measuring core factors

Meeting the objectives of managing interest costs over time, at an acceptable level of risk involves considering a number of factors

Meeting the objectives of managing interest costs over time, at an acceptable level of risk involves considering a number of factors

The overall level of interest costs arises from the capital structure and headroom decisions the firm makes. We will look at financing and capital structure decisions in a later article, but it is worth remembering that the funding decision and the maintenance of adequate liquidity and headroom will always result in unavoidable interest costs. Within this capital structure framework, the Treasurer will seek to control:

The table one below summarises some areas where interest rate risk can impact the firm. This can be in obvious and visible areas such as the interest charge in the income statement. Slightly less obvious are the effects that flow through the balance sheet now that accounting standards bring so much mark to market recognition and discounting methodology. Lastly, interest rates reflect the level of economic activity and the influence this has to a greater or lesser degree on the firm’s overall levels of operating profit. Table one describes some of these exposures.

| Exposure | Description |

| Debt and cash | Debt when combined with derivatives to transform either the currency and/or the fixed or floating nature of interest on debt can offer a versatile instrument with which to hedge other sources of interest rate risk and manage the interest cost itself. |

| Pension scheme assets

(defined benefit) |

As many pension scheme assets are directly or indirectly linked to equity, periods of economic expansion usually boost values. Conversely low interest rates, particularly in the current environment where their purpose is to support asset values, also supports higher valuations. |

| Pension scheme liabilities

(defined benefit) |

These are very sensitive to the discount rates applied to future cash outflows. Negative real interest rates for example can be a significant drag with inflation effecting the absolute value of future cash flows as well as dragging down the discount rate applied to these future liabilities. |

| Leasing | As a form on financing, the cost of leasing has always been subject to interest rate risk embedded within the lease rental payments. The new leasing accounting standard now forces visibility of the interest cost inherent within a lease although in a somewhat false sense. |

| Foreign exchange | Over the long-term economic and interest expectations drive the direction of exchange rates. For example, emerging markets with higher interest rates often see year on year devaluation while at the same time it is often difficult to justify the high hedging costs of borrowing in these currencies. |

| Business operations | Firms will be impacted to a greater or lesser degree by the general economic environment and the influence this has on interest rates. The firm’s pricing sovereignty and the nature of its cost base strongly influence whether the firm has a high earnings exposure to fluctuating interest rates, the inflation environment and GDP growth. |

Table one: Sources of interest rate exposure within the firm

How the firm manages interest rate risk is dependent on the sources of interest rate risk within the business and the size of the exposure. That said, a focus on the interest arising from borrowings, earned on cash and the effect of the overall health of the economy on business performance are primarily the treasurer’s concern when designing an interest rate policy.

The starting point in managing interest rate risk is a thorough understanding of the Firm’s strategic position and operating model. There is a temptation to think of interest costs in isolation to business activities the firm undertakes. For example, focusing on economic forecasts of where interest rates might head or looking at the sophisticated products that banking partners put forward are essential parts of the treasurer’s role, but have always got to be anchored in a holistic understanding of the nature of the business when deciding how to manage interest rate risks.

There are certain elements of the firm’s strategy and operating model that influence the management of interest rate risk. Table two summaries some of these.

| Exposure | Description | Influence on interest rate |

| Operating gearing | The level of fixed to variable costs determines the sensitivity of profits to changes in revenue. | Higher operating gearing (fixed costs) dictates floating interest costs |

| Capital intensity | High capital intensity in cash flow terms should be thought of as a fixed cost, similar to high operating gearing | Higher fixed capital intensity dictates floating interest costs. |

| Pricing duration | The duration over which pricing and revenue are fixed. | Longer periods of pricing duration dictates fixing interest costs. |

| Product differentiation | Substitute or discretionary product types experience more sensitivity to economic conditions than “staples”. | Staple products give in effect longer pricing duration and can supoprt fixing interest costs. |

| Inflation | The degree to which profitability reacts to changes in inflation. | Profitability that is reactive to changes in inflation dictates floating interest costs. |

| Risk appetite | The risk appetite of the firm’s owners determines capital structure and the levels of debt assumed by the firm | A higher risk appetite dictates floating interest costs. |

| Currency exposure | Understanding the underlying currency exposures within a firm is vital. These may not be the obvious transactional currencies the firm conducts its business in. | Borrowings and interest costs should be matched to the underlying currency exposures within the firm. |

Table two: Strategic influences on interest rate risk management

For example, an online consumer facing firm with relatively low operating gearing and capital requirements operates in a highly competitive marketplace. Pricing is generally anchored to the market norm, but the firm can change prices in reaction to these levels reasonably quickly. The firm considers a floating rate interest stance most appropriate, as its business generates more revenue when the economy is growing, and when interest rates tend to increase.

Taking a second example of a capital-intensive business, with high fixed costs and operating long term fixed price contracts. The firm has long term visibility of its revenue and cost base. While high operating gearing and capital intensity would steer towards borrowing at floating interest rates, the firm’s revenue is also fixed over the long term and contains inflation protection. Fixing or capping most of the interest cost is appropriate in these circumstances and the level to which this is done will depend on other factors such as the firm’s capital structure and overall risk appetite.

Having looked in some depth at the performance of borrowing at floating rates of interest versus fixing in the previous article the conclusions were that borrowing at floating rates of interest over a rolling three-year time frame is cheaper than fixing for the same period approximately 75 percent of time over the past twenty-five years. These odds can be improved by circa four percent and six bps by also considering the level of real interest rates (interest cost adjusted for inflation) prevailing at the time. We start therefore from a point at which borrowing at floating rates is a default policy position on a purely interest cost basis. Our question therefore is what factors may change this default position?

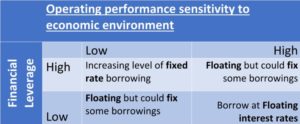

Table three illustrates a very simple interaction between the firms’ sensitivity to the economic environment, its level of financial leverage and the influence these two factors have on whether the interest charge should be fixed or left to float. We have covered many of the influences on operating performance in table two. Where table three refers to the degree of financial leverage this may address several areas including interest costs as a proportion of earnings per share, covenants or credit rating metrics. Our online consumer facing business would appear towards the bottom right in table three, with a floating interest stance.

Table three: Interest rate risk management is influenced by the level of leverage and the sensitivity of the business to the economic (interest rate) environment.

Of course, the considerations we have discussed are also set within the context of time. Even very natural floating rate borrowers may want to fix interest rates in the short term to provide some certainty over costs. Our capital-intensive fixed price business is certainly on the left-hand side of table three and depending upon the level of financial leverage, another risk decision, an increasing level of fixed rate borrowing becomes appropriate. Bring in the time dimension into the equation and the duration over which the interest charge is fixed should have some semblance to the weighted duration of the fixed priced contracts the firm has in place at the time.

The definition of an interest rate policy must consider a number of factors which include the elements of the income statement and balance sheet where there is exposure to interest rates. The operating model including pricing, costs and capital requirements influence business performance in different interest rate environments and the policy must take this into account. Capital structure, risk appetite and headroom also feed into the policy. The policy must reflect these factors and retain the flexibility to allow the treasurer to implement policy in the most cost-effective manner.