Climate Bonds Initiative calls for greening of $55trn short-term debt market

Leveraging short-term instruments will be crucial for corporates to achieve net zero objectives

Leveraging short-term instruments will be crucial for corporates to achieve net zero objectives

Green finance for corporates to date has largely been limited to long-term debt markets but Climate Bonds Initiative is championing its expansion into the $55trn market for commercial paper and other short-term instruments, arguing the move is essential if net zero objectives are to be met.

Climate Bonds Initiative, a non-profit green bond certification body, says global short-term debt markets offer an enormous pool of capital, on top of the global $130trn bond market, in which green finance can thrive. The certification body, which has just published a discussion paper on green short-term debt, believes broadening the reach of climate considerations into new corners of global capital can boost investment towards its objective of $5trn in annual green finance by 2025.

“Trade and working capital finance, as well as money market instruments, has attracted little attention in the sustainable finance market,” according to Climate Bonds Initiative. “However, to achieve capital flows at the required speed and scale, investors must be able to identify all types of green finance instruments.”

Climate Bonds has already had some encouraging early experience in certifying short-term green issuances, including French railway operator SNCF leveraging green commercial paper to pre-finance projects later funded via green bonds, as well as New Zealand’s electricity generator Contact Energy which used commercial paper to support renewable energy projects.

“Climate change represents a generational crisis and by intervening now, finance can emerge when we need it most,” says Michel Pinto, advisory panel member at Climate Bonds Initiative, and a former vice president of treasury at Unilever.

“The industry must reward issuers with strong environmental practices and the ideas presented in this Climate Bonds paper related to the short-term debt markets, offers a platform for finance to do this.”

Jonathon Stone, treasurer at Climate Bonds Initiative, and former Barclays Group treasurer, adds: “We are taking the investment demand that has been witnessed in the bond market and unleashing it into a huge untapped pool of finance. The estimated $55trillion volume of the short-term debt markets can open doors to investors looking to feast on climate-conscious capital.”

Climate Bonds Initiative says that one reason an issuer may use short-term debt instruments is greater flexibility. An issuer can use short-term debt as a layer to its general funding policy, flowing into its longer-term capital structure, as green projects establish critical funding mass.

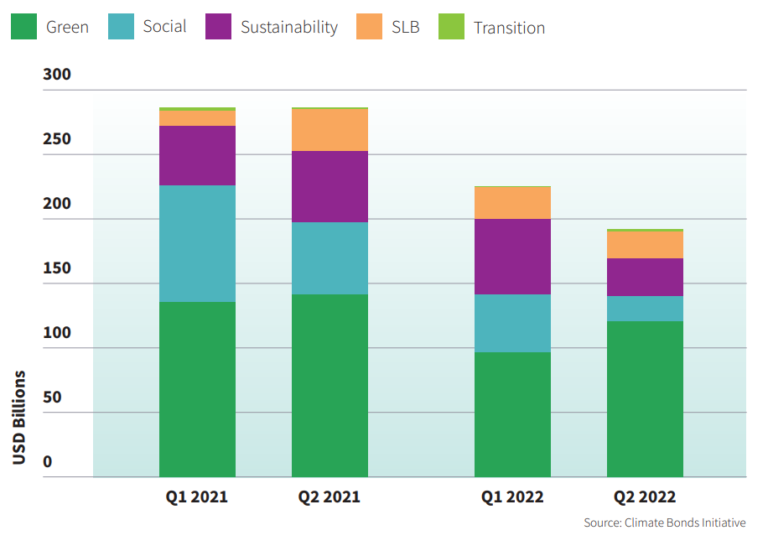

In a separate announcement, Climate Bonds Initiative also revealed this week that green, social, sustainability, sustainability-linked and transition (GSS+) labelled debt reached a combined volume of $418bn in the first half of 2022, representing a year-on-year decrease of 27% against the same period last year.

However, there are signs of a revival in green issuance, which accounted for just over half of total GSS+ issuance, increased by 25% in the second quarter versus the previous quarter, on volume of $121.3bn.

Climate Bonds Initiative says the Russian invasion of Ukraine in February and the subsequent European energy crisis exacerbated post-pandemic inflation, impacting bond market dynamics in the first half, with rising rates and high volatility dampening investor enthusiasm for bond issuance across the GSS+ space.

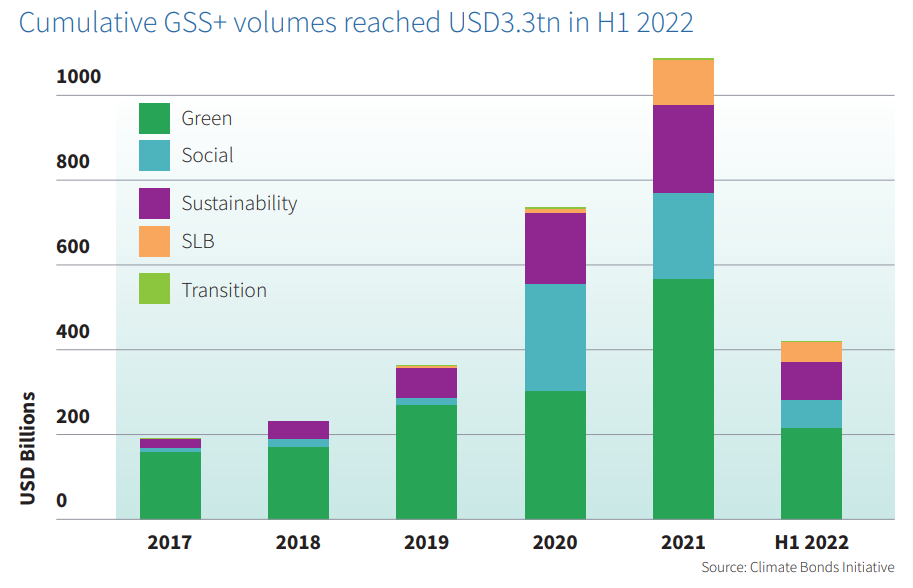

Cumulative volumes of labelled (GSS+) issuance stood at $3.3tn at the end of the first half, with green cumulative volumes at $1.9tn.

“It has been a difficult year for the global bond market, and this hasn’t gone without consequences for labelled debt issuance,” says Krista Tukiainen, head of markets and data at Climate Bonds Initiative. “However, signs of a rebound did emerge in the second quarter of the year, and we expect a steady revival to continue throughout 2022.”