Federal Reserve lowers interest rates as Jay Powell rejects resignation rumours

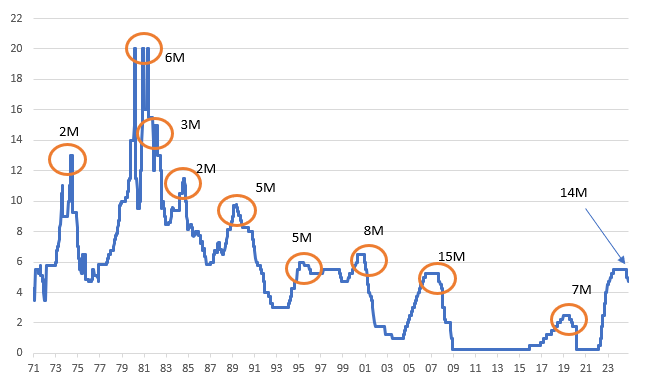

The Federal Reserve’s Federal Open Market Committee (FOMC) has reduced the target range for the federal funds rate by a quarter percentage point, setting it at 4.5% to 4.75%. This decision, made unanimously, reflects the Fed’s cautious approach in light of both solid economic growth and lingering inflationary pressures.

At Thursday’s meeting, Fed chair Jay Powell said he would not resign if incoming president Donald Trump asked him to. The Fed’s two-day meeting started on Wednesday, a day later than usual because of Tuesday’s US election, in which the Republicans trounced the Democrats.

The FOMC noted that recent indicators point to continued expansion in U.S. economic activity. The labor market, while still strong, has shown signs of easing, with a slight increase in the unemployment rate. However, unemployment remains low by historical standards, supporting the Fed’s view of a resilient job market.

Inflation has moderated closer to the Fed’s 2% objective, though it remains “somewhat elevated.” The Committee emphasized its dual mandate of promoting maximum employment and stable prices, acknowledging that risks to achieving these goals are “roughly in balance.”

The FOMC’s decision signals a delicate balancing act, as it seeks to support economic growth without overstimulating inflation. To that end, the Fed will continue to reduce its holdings of Treasury securities and agency-backed securities, maintaining a steady approach to tightening the monetary supply.

Moving forward, the Committee stated it would closely monitor economic data and adjust its stance if new risks to its employment and inflation goals arise. Fed Chair Jerome Powell and other FOMC members remain vigilant about evolving economic conditions, stressing a data-driven approach that takes into account labor market conditions, inflation expectations, and global financial developments.

During the press conference, Powell refused to answer journalist’s questions on how the central bank would respond to Trump’s incoming administration. He said it was too early to judge what the substance of a Trump government’s economic policies would be.

“We don’t guess, we don’t speculate and we don’t assume,” Powell said.

While Fed’s independence is written into law, Trump has – in the past – criticised the FOMC for not cutting borrowing costs quickly enough during his first term. Trump will have the opportunity to nominate a new chair once Powell’s term ends in May 2026.

Some of Trump’s advisers have called on him to ask Powell to step down early. When asked whether he would agree to do so, the Fed chair emphatically said “no”. He added curtly that it was “not permitted under the law” for a new administration to dismiss him ahead of the end of his term.

With inflation showing signs of moderation and a steady but cooling labor market, the Federal Reserve seems positioned to continue gradually easing monetary policy toward a more neutral stance.

Another 0.25% rate cut in December appears likely, though the trajectory after that remains uncertain, with a possible pause at January’s FOMC meeting.

Market expectations had previously placed the Fed funds rate around 3-3.5% by mid-next year. However, with Donald Trump securing a second term, his expanded policy focus—such as further tax cuts, tariffs, and immigration controls—could offer near-term economic support but may prompt Fed concerns over inflation risks tied to trade restrictions and labor constraints.

A cooling job market remains a focal point, while the significant rise in long-term Treasury yields (up 80-90 basis points since September) could pose a headwind for growth.

The Fed’s upcoming December projections will offer a clearer view of its assessment of Trump’s renewed policies. While Trump’s campaign platform laid out ambitious goals, the actual policy implementation remains uncertain. The Fed will aim to avoid pre-emptive actions on policies that may evolve, but its outlook on “Trump 2.0” policies in December will be insightful.