The landscape of investment funds in 2025 presents a complex interplay of economic uncertainties, evolving market dynamics, and emerging strategic imperatives. Moving beyond basic liquidity management, today’s environment demands a nuanced and forward-thinking approach to deploying corporate capital through investment funds.

The Persistent Shadow of Uncertainty

A persistent undercurrent of economic and geopolitical uncertainty has marked the first half of 2025. Recent data reveals that UK investors, for instance, have been net sellers of bond funds amidst turmoil in the US Treasury market, triggered by concerns surrounding potential tariff policies. This flight to safety is also reflected in significant inflows into money market funds in both the US and the UK, highlighting a cautious stance among investors. This environment necessitates that corporate treasurers prioritize robust risk management and maintain a flexible approach to investment strategies.

Beyond Short-Term Parking

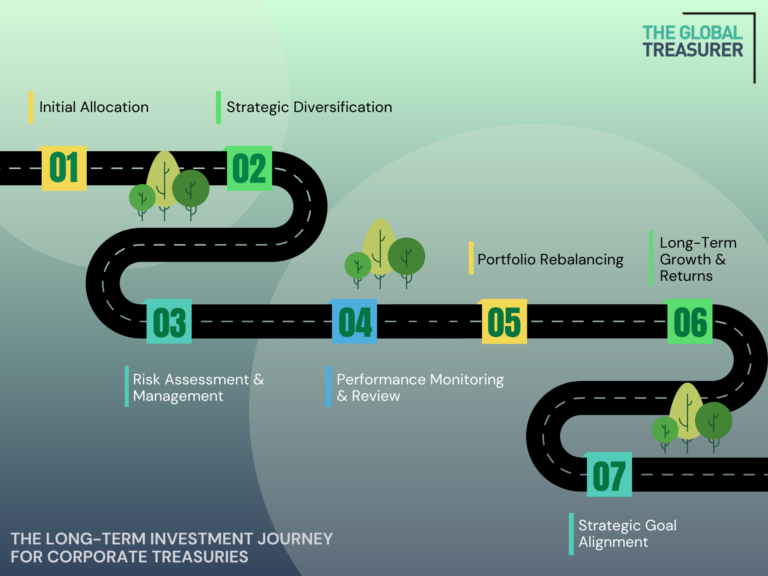

While money market and short-term liquidity funds remain essential for immediate cash needs, the current climate compels a more strategic consideration of other fund types. With potential interest rate fluctuations on the horizon, simply parking excess cash in low-yielding accounts may not be the optimal strategy. As some analysts suggest, a move towards high-quality, investment-grade bond portfolios for longer-term cash holdings could offer better returns if interest rates do indeed trend downwards.

Thematic Investing and Long-Term Strategic Alignment

Thematic funds continue to garner attention, offering exposure to potentially high-growth areas such as artificial intelligence, clean energy, and infrastructure. For corporate treasurers and CFOs, these funds present an opportunity to align investments with the company’s long-term strategic vision or gain exposure to sectors critical to their future. For example, a manufacturing company might strategically invest in a fund focused on industrial automation. However, this requires a deep understanding of the underlying trends and the specific risks associated with concentrated sector bets.

Passive vs. Active

The debate between active and passive management remains pertinent. While passive funds offer cost-effective broad market exposure, the current environment of volatility and potential market dislocations could present opportunities for skilled active managers to generate alpha. Corporate treasurers should regularly evaluate the performance and fees of both active and passive strategies to determine the optimal blend for their corporate investment portfolio, considering their specific risk appetite and investment objectives.

The Imperative of Due Diligence and Risk Management

In this dynamic landscape, rigorous due diligence on any investment fund under consideration is paramount. This includes a comprehensive assessment of the fund’s investment strategy, historical performance (with the crucial caveat that past performance is not indicative of future results), expense ratio, the experience and expertise of the fund management team, and the overall risk profile. Establishing clear investment guidelines and risk parameters within the corporate treasury policy is more critical than ever.

Technology as an Enabler for Strategic Decision-Making

Sophisticated treasury management systems and analytical tools are becoming indispensable for corporate treasurers. These technologies provide enhanced visibility into cash positions, facilitate more accurate forecasting, and enable better monitoring of investment fund performance and associated risks. Leveraging these tools is crucial for making timely and informed investment decisions in a rapidly evolving market.

Emerging Trends and Strategic Considerations for 2025

Looking ahead, several key trends are shaping corporate treasury investment strategies:

- Increased Focus on Data: Access to clean, usable data is becoming the cornerstone of effective treasury operations, enabling better decision-making and automation in investment management.

- Real-Time Treasury: The move towards real-time visibility of cash flows and investment positions is gaining momentum, demanding enhanced connectivity and data integration.

- Digital Assets as a Tool: While not yet a mainstream asset class for most corporations, a strategic consideration of digital assets and the underlying technology may emerge as part of a broader diversification strategy for some.

- ESG Integration: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, with corporations seeking funds that align with their sustainability goals.

Navigating the investment fund landscape in 2025 requires a strategic mindset that goes beyond traditional approaches. By staying informed about market uncertainties, carefully evaluating different fund categories, prioritizing robust due diligence and risk management, and leveraging technological advancements, corporate finance leaders can effectively deploy capital through investment funds to enhance returns, manage liquidity, and align investments with their overarching strategic objectives in an increasingly complex global environment. The ability to adapt and proactively respond to evolving market conditions will be the hallmark of successful corporate treasury management in the year ahead.