On Tuesday, the bond market opened September trading with a significant jolt, as U.S. Treasury yields jumped across the board. The 30-year bond yield climbed to 4.995%, and the benchmark 10-year yield reached 4.296%. This sharp move wasn’t triggered by a new Federal Reserve announcement or a key jobs report. Instead, it was sparked by a federal appeals court ruling that exposed a critical vulnerability in U.S. fiscal policy.

The court’s decision, which deemed most of the Trump administration’s tariffs illegal, has created the prospect of the government having to refund billions of dollars already collected. This potential financial liability adds new strain to an already-stressed U.S. fiscal situation. For investors, it raised questions about the government’s ability to manage its ballooning budget deficit without increased borrowing, which would put upward pressure on yields.

The Economic and Market Dynamics

1. Tariff Revenue as a Financial Crutch:

For the past few years, revenue from tariffs has been a quiet but significant contributor to the federal government’s finances. This income, projected to be substantial, provided a small counterbalance to the nation’s debt. Bond investors had begun to factor this revenue into their assessments of the government’s fiscal health. The court ruling threatens to pull this revenue stream out from under the Treasury, leaving a larger gap to be filled by new bond issuance. As with any market, an increase in the supply of bonds (issuance) puts downward pressure on their prices and, in turn, drives their yields higher.

2. The Return of “Bond Vigilantes”:

The term, coined by strategist Ed Yardeni, refers to investors who sell bonds and demand higher yields to “discipline” governments with unsustainable fiscal policies. This recent event, coupled with rising yields in Europe due to their own fiscal challenges, suggests that investors are becoming increasingly sensitive to government debt and fiscal fragility. The tariff ruling provided a clear, domestic catalyst for this behavior, reminding the market that government revenue is not guaranteed and that ballooning deficits may require more aggressive borrowing.

3. Global & Political Context:

While the tariff ruling was a key driver, yields were already rising globally. The market’s reaction reflects a broader concern about governments’ ability to service growing mountains of debt. The court’s decision, and the potential for a Supreme Court appeal, adds a layer of political uncertainty that the markets dislike. This uncertainty complicates economic forecasting and can lead investors to demand a higher risk premium to hold long-term government debt.

The outcome of the legal battle and the government’s subsequent fiscal response will be closely watched. This event underscores the interconnectedness of legal rulings, fiscal policy, and market dynamics, showing how an unexpected headline can instantly shift the cost of government borrowing.

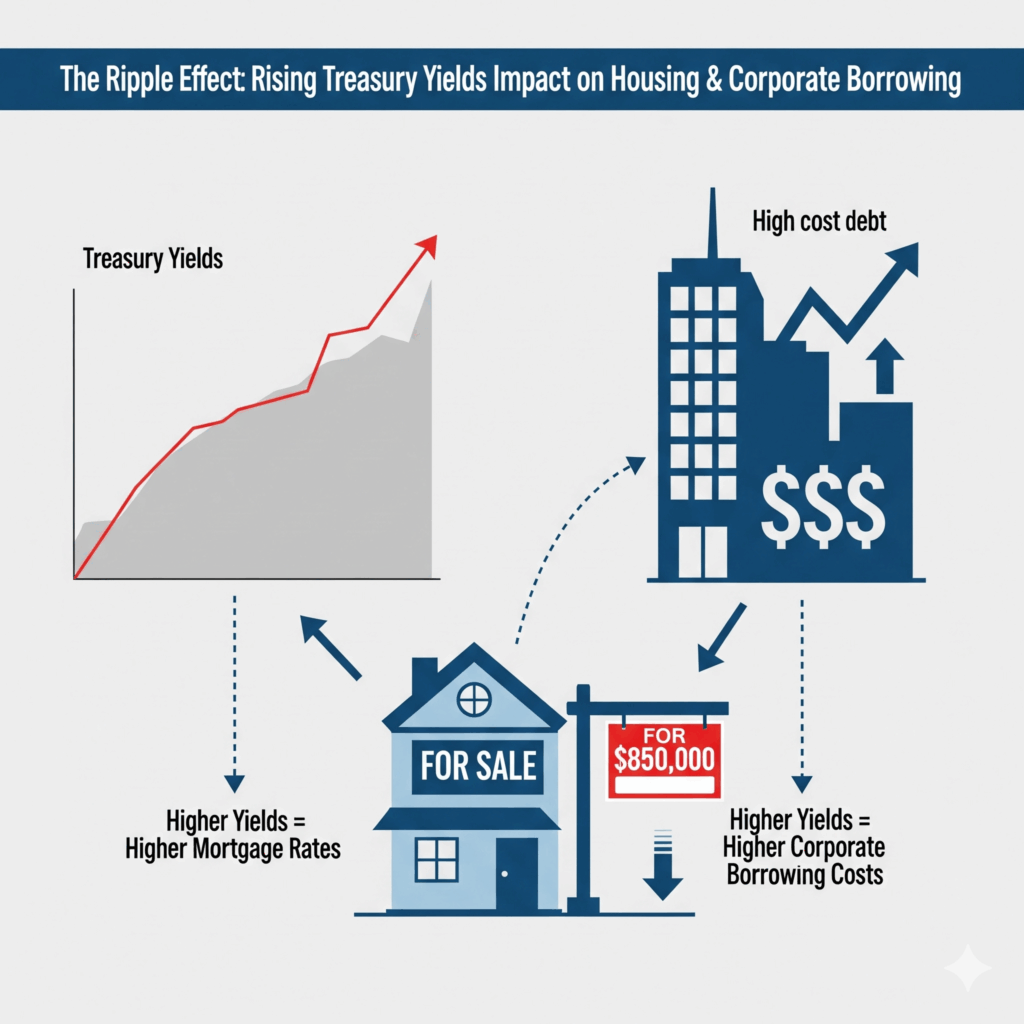

This jump in Treasury yields has a direct and significant impact on both the housing market and corporate borrowing. Because Treasury yields serve as the benchmark or “risk-free” rate for a vast number of other financial products. When this baseline rate rises, so do the costs of borrowing for both businesses and consumers.

Impact on the Housing Market 🏡

The housing market is particularly sensitive to changes in long-term Treasury yields. This is primarily because mortgage rates are closely tied to the yield on the 10-year Treasury note. When the 10-year yield increases, lenders must offer higher mortgage rates to maintain their profit margins and to attract investors who could otherwise buy government bonds.

- Higher Monthly Payments: For potential homebuyers, a rise in mortgage rates means a higher monthly payment for the same loan amount, which directly impacts affordability and can price many buyers out of the market.

- Reduced Buyer Demand: As borrowing costs increase, buyer demand tends to slow down. This can lead to a decrease in home sales and, in some cases, a moderation or decline in home prices.

- Discouraging Existing Homeowners: Many existing homeowners are reluctant to sell because they have a locked-in, low fixed-rate mortgage. They don’t want to trade that for a new, higher-rate mortgage, which can decrease the supply of homes on the market.

Impact on Corporate Borrowing 🏢

Rising Treasury yields also directly affect companies’ ability to raise capital. Corporations often benchmark their borrowing costs against a relevant Treasury yield, adding a spread to account for their specific credit risk.

- Increased Cost of Debt: For companies that need to issue new bonds or refinance existing debt, higher Treasury yields translate to a higher cost of borrowing. This can cut into a company’s profitability and make it more difficult to fund new projects, expansions, or acquisitions.

- Impact on Valuation: Rising yields can make bonds more attractive to investors compared to stocks. This can lead to a shift of capital from equities to fixed-income assets, potentially putting downward pressure on stock prices.

- Strategic Reprioritization: With capital now more expensive, companies may be forced to re-evaluate and postpone or cancel projects that have a lower return on investment. This can lead to a more conservative business strategy and a slowdown in economic growth.

In this new reality, where fiscal policy can send market signals just as strongly as monetary policy, the bond market is proving to be a critical barometer of U.S. financial health. The recent jump in yields is a wake-up call, showing that investors are now actively scrutinizing a wider range of factors, from court rulings to government spending to determine the true cost of borrowing. For corporations and consumers alike, understanding this new dynamic is no longer optional; it’s essential for navigating an increasingly complex financial landscape.