Digital guarantee management with TIP at Deutsche Telekom

Find out how Deutsche Telekom moved from tedious paperwork to electronic process management with the help of TIP.

Find out how Deutsche Telekom moved from tedious paperwork to electronic process management with the help of TIP.

Given that guarantee management generally involves several departments, subsidiaries and external partners, the coordination work is often extensive. When a subsidiary needs a guarantee, it often takes days from the time the request is generated until the many pages of documentation have made the rounds and the guarantee is finally issued. Double data entries are not rare, cost everyone involved lots of time, and lead to mistakes. And, since high volumes generally mean that several approvals are necessary, the delays just get longer.

Due to the fact that Deutsche Telekom currently has around 4,800 active internal and external guarantees in effect, with a total volume in the billions, a project was launched in 2017 to do away with the reams of paper involved and to digitalise the guarantee management process as far as possible. From requests for internal or external guarantees and the internal approvals process, to the sending of requests to the bank and the issuing of hard copies in the case of group-level guarantees as well as the associated reporting.

Kathrin Rößler, responsible for guarantee management at Deutsche Telekom, explains: “The aim was for paper-based requests which were previously circulated within the group and later forwarded to the bank by fax, email or post, to become a thing of the past. We wanted to cut the throughput times and reduce the tedious keyboard entries in order to have more time for analyses.”

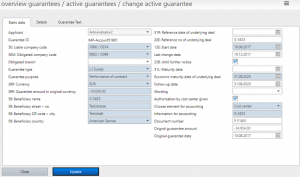

Deutsche Telekom has been using the treasury software TIP for many years and the intention was to also use this system for group-wide guarantee management. Since the end of 2017, the local Deutsche Telekom subsidiaries have been capturing their guarantee requests using a standardised form directly in TIP (see Figure 1). Group Treasury is automatically informed about new requests via the workflow and then decides in the next step whether and how this should be processed.

Once Group Treasury approves a request, the competent treasurer can select the bank or credit insurer which is to issue the guarantee, all with a click of the mouse in TIP. From the outset, it is thus possible to fine-tune the utilisation rate of the guarantee line negotiated with the relevant counterparty and to carefully manage the allocation of business to banks.

In the past, it was common practice at Deutsche Telekom to complete different guarantee request forms for every bank. This meant that requests had to be processed individually, which just added to the complexity. Given that the contents of the forms were largely identical, it was also possible for Deutsche Telekom to optimise things here. They decided to replace the numerous different forms with one standardised form. This is pre-filled with the relevant master data in TIP, meaning that only the specific details relating to the relevant guarantee need to be added. And what’s even more practical: Printing, signing and scanning the documentation is no longer necessary with this process due to the fact that the treasurer signs the request digitally and can send it directly from TIP to the bank via email at the click of a button (see Figure 2).

Due to the fact that the Deutsche Telekom Group issues around 800 new guarantees every year, the aim was also to standardise the request process as far as possible. The banks offered support during the discussions and it was possible to jointly resolve all of the associated legal issues. The results achieved so far are impressive: In the meantime, all of the banks and credit insurers approached have accepted the standardised TIP form and electronic signatures instead of the various hand-signed, paper-based forms. This is a milestone in terms of digitalisation and standardisation.

But Deutsche Telekom is going a step further, as David Hoeren, Vice President Treasury Management & Systems, explains: “The standardisation of the guarantee requests is leading to a standardisation of the associated IT processes and, therefore, to a higher degree of simplification. The next step in the direction of an end-to-end digital process is to send the guarantee requests via SWIFT FileAct.”

Group-level (internal) guarantees can also be requested and issued in TIP. Once the purpose of the guarantee has been clarified and the group-internal guarantor defined, the guarantee certificate is dynamically generated in TIP based on the details already captured. This automated issuing of the certificates saves everyone involved clarification work and therefore valuable time. What used to require many interventions until recently can now be resolved by Group Treasury in Bonn in just a few clicks. The fact that everyone involved can add comments directly to the guarantee request in the workflow means that the number of queries in the entire request process has been significantly reduced and these can also be clarified faster. Manual reprocessing is no longer necessary.

Besides maximising the levels of standardisation and digitalisation, two other aspects were also important for Deutsche Telekom: independence from specific individuals and compliance with group policies. The requirements were for it to be possible to clearly define authorisation levels and deputisation rules, and to ensure that these are complied with.

It was also demanded that the route of a guarantee request through the workflow must be accompanied by an end-to-end audit trail. Kathrin Rößler: “In TIP, every request passes through a number of phases, each associated with specific tasks for the relevant personnel. An audit trail for every request highlights who did what when and why.”

Another aspect of the “digital office” in TIP: An integrated document management system which allows treasurers to save all of the documentation related to the underlying transaction and copies of the certificate directly linked to the guarantee and to access these at any time (see Figure 4).

After guarantees have been issued, the associated fees also need to be regularly checked and invoiced. Once these have been allocated to fee classes, they can easily be calculated and allocated in TIP. Clear differentiations are possible between issue and amendment fees as well as minimum commission charges. External fee classes make it possible to check the fees charged by banks and credit insurers. A single glance is all it takes for Group Treasury to see which amounts need to be internally charged to the relevant subsidiaries and the accounts department spends less time entering fees and setting up associated accruals. Group Treasury can also analyse the utilisation of guarantee lines in TIP at the press of a button (See Figure 5).

Today, digital guarantee management at Deutsche Telekom works (nearly) at the touch of a button. Naturally, you still need the expertise of an experienced treasurer, but the tedious coordination/clarification work and the manual processing of numerous forms and certificates are now a thing of the past. Kathrin Rößler puts it in a nutshell: “We have standardised and digitalised the internal request process and created a group-wide database for internal and external guarantees – including an audit trail and completely digital document storage. In addition, the integrated reporting also provides many advantages for Accounts and Group Treasury.”

As Hoeren adds: “For me, the key to the success of the project is that we were forced to review our processes and analyse these for potential improvements. Only then was it possible for us to optimise and digitalise guarantee management with the help of TIP.”

About Deutsche Telekom AG:

Deutsche Telekom is one of the world’s leading integrated telecommunications companies, with some 178 million mobile customers, 28 million fixed-network lines and 20 million broadband lines. The company provides fixed-network/broadband, mobile communications, Internet and IPTV products and services for consumers, and information and communication technology (ICT) solutions for business and corporate customers. Deutsche Telekom is present in more than 50 countries. With a staff of some 216,000 employees throughout the world, the company generated revenues of 75,7 billion Euros in the 2018 financial year, about 66 percent of it outside Germany.

About TIPCO:

TIPCO is a leading provider of digital solutions for Corporate Treasury departments. Whether the focus is on cash visibility, cash flow forecasting, risk management, guarantee management or bank fee analysis, the web-based Treasury Information Platform TIP leverages data from various source systems, supplements these with information provided by local subsidiaries and offers a comprehensive toolbox for data analysis and reporting. TIP empowers Treasury departments to digitalise their processes and do away with manual data capturing and endless e-mail exchanges. No matter if requests for intercompany financing, guarantees or bank accounts: TIP workflows engage the right people and the right systems at the right time, resulting in a smarter and more efficient Treasury. By combining IT-skills with many years of treasury expertise, TIPCO has made TIP the solution of choice for some of the leading companies in Europe across various industries. More than 120 clients trust in TIP and in TIPCO’s ability to provide market-leading treasury innovation.