Case study: BNP Paribas provides insurance automation

Ociane Matmut and BNP Paribas embark on real-time payment partnership

Ociane Matmut and BNP Paribas embark on real-time payment partnership

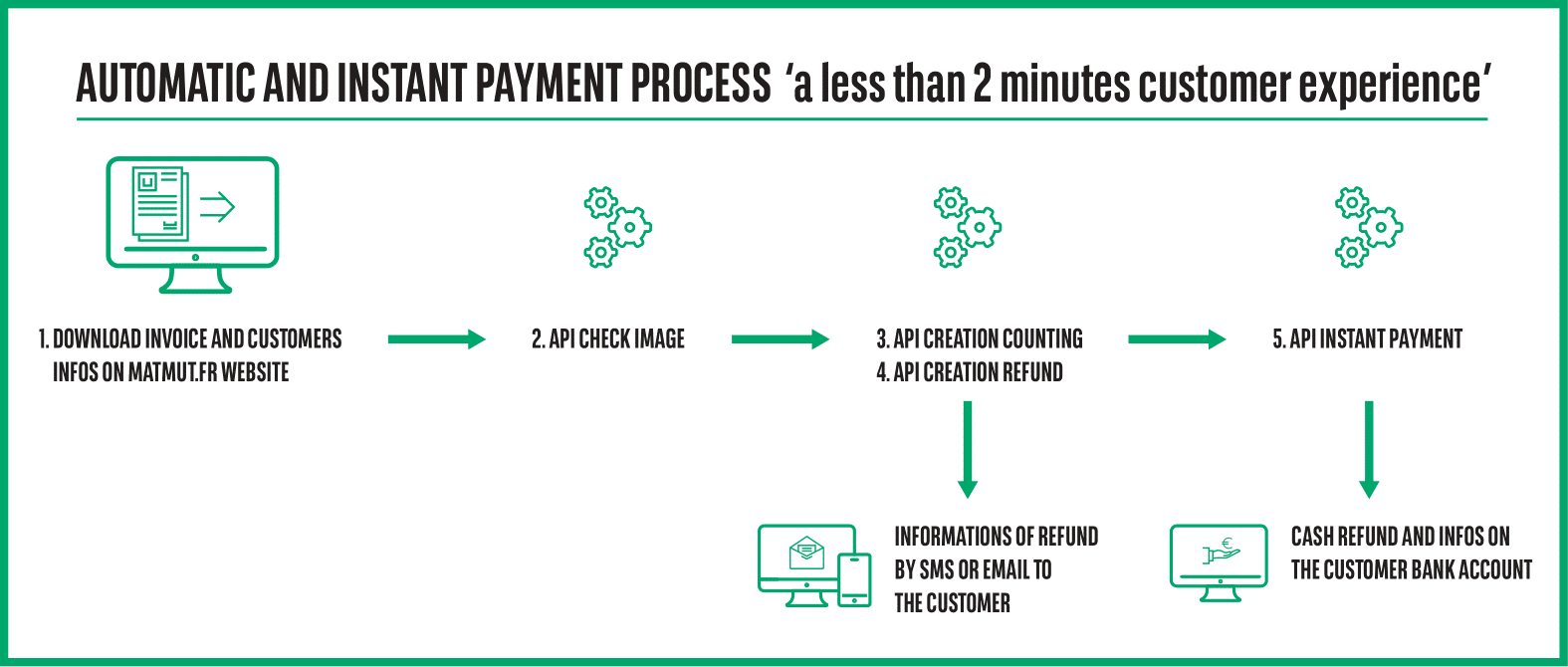

For health insurers, processing reimbursement claims into the thousands every day can be a huge resource drain – taking up valuable time and effort, representing huge costs to the organisation. French health insurance provider Mutuelle Ociane Matmut wanted to simplify and automate the process – but given the complexities and importance of its requirements, finding a partner to work with would be a highly selective procedure. The organisation approached one of its banks – BNP Paribas – which was able to offer its new corporate application programming interface (API)-based real-time payment solution.

This newly formed partnership will be the first of many as BNP Paribas rolls out its new business-oriented APIs. For Ociane Matmut the benefits of utilising an API network are twofold: the automation of invoice processing, and the ability to make instant payments.

“[The biggest change] is around the manual processing of the invoices. Previously, when the customer sent an invoice either through regular mail, email or Ociane Matmut’s website, they all needed manual treatment. Now, this no longer the case because the invoice process is fully automated”, says Stéphane Hasselot, CEO of Mutuelle Ociane Matmut.

Ociane Matmut is now the first French health insurance company that allows for instant reimbursement of medical fees. An invoice received by Ociane Matmut can be instantly recognised and processed using BNP Paribas’s API network – so the customer can see the funds in their bank account in as little as five seconds.

“In the past, we needed two or three days to process and reimburse an invoice. Using BNP Paribas’ API network, we’re able to make instant payments. Through instant payments the customer is able to see in their own bank account that the money has been received. Finally we replaced three days with five seconds.”

Steven Lenaerts, head of product management at BNP Paribas says that the utilisation of bank APIs are key to streamlining business processes.

“What used to be the business process was that following a claim, a bank interaction took place. Now, the bank interaction is integrated in the business process,” he says. “This yields greater efficiency for Ociane Matmut in terms of processing and managing claims. The true benefit is if you integrate bank services into the overall payment process, it optimises the business.”

The partnership between Ociane Matmut and BNP Paribas demonstrates the advantages that come with open banking and Europe’s second payments directive (PSD2). While the directive has altered the financial services landscape, banks like BNP Paribas are aiming to better the relationships they have with corporates by utilising APIs and other proprietary technology.

“If we look at PSD2, it was mostly oriented towards retail banking or serving private individuals. It has a number of limitations that need to be overcome in order to yield true benefits for corporates,” says Lenaerts.

“On the other hand, corporates do not necessarily require a regulation to demand a complementary means of connectivity to a bank. We have had a number of corporates expressing their interest in API connectivity.”

What APIs can offer

With Europe in the early stages of restarting its economy, cash forecasting and liquidity continue to remain the number one priority for corporates – a trend that is likely to continue. The use of bank APIs will be key in enabling immediate access to a company’s cash flow. Lenaerts says BNP Paribas’ API network will facilitate this.

“Companies are looking to leverage APIs to give them the real time balance of their accounts or their consolidated liquidity position. What they want is a service, which can be provided in an API mode that provide answers to questions like ‘what is my liquidity position at this moment in time’. I believe the use of API connectivity can be complementary to what already exists on the market”.

Although the partnership between BNP Paribas and Ociane Matmut in corporate API networks has only just begun, Hasselot already sees the opportunities in which APIs will help the finance department.

“Concerning cash visibility, the process and the entire operation is completely automatic. It saves time since you do not have to check the bank accounts as often. For treasury forecasts, we can receive information immediately now, where previously it took two or three days. If we want to, we are able to view cash and do cash flow forecasts more easily than in the past.”

APIs can also help address growing instances of fraud, which has been worsened by the pandemic. APIs that can be connected directly with a company’s enterprise risk planning (ERP) system will enable greater security without adding to manual processes, says Lenaerts.

“Banks sit on a lot of data. What you can do now, which is not a classical bank function, is when you have an invoice, you put the invoice and the payee’s data into your ERP. However, what you could also do is have a check before storing that data into your ERP where it ‘calls’ the bank.

“The bank will respond either ‘yes’ or ‘no’ via API. If the response is ‘no’ the process can be stopped and an exception handling process put in place. If yes, these are the correct bank details, then the details are stored into the ERP and you can safely make the payment to that payee.”

Future of things to come

Both BNP Paribas and Ociane Matmut have high hopes for the partnership, with the insurer aiming to ramp up the number of invoices that are processed in real-time.

“It’s the beginning of the adoption. The volume of invoices is not that big now, but as we develop the process it will be easier for the treasury department to deal with cash in the future.”

The bank is also looking to develop its API network and is mindful of the changing compliance agenda.

“There is currently no universal standard for APIs. we will draw from the ISO standards like ISO 20022 and make sure we are PSD2 compliant,” says Lenaerts. “One of the challenges for APIs is while technology has been there for years and is mature, it is how to use that technology in an open banking environment. There is still progress to be made in terms of uniformisation and standardisation.”

While relationship and bank has never been stronger, BNP Paribas has identified a number of avenues it can assist clients with – and consider now to be an exciting time for treasurers as it looks to evolve its offering.

“There’s a huge range of value-added services where APIs could be applied. Services like tracking incoming payments to further enrich liquidity, or market data and data analytics APIs,” says Lenaerts. “There’s a lot of possibilities that exist around APIs, the first wave is organised around account information and payments, but we can go beyond that.”