Why Corporate Treasurers Are Losing Sleep Over Bank Safety and Liquidity

Corporate treasurers aren’t sleeping easy. A wave of high-profile bank failures has sent a shock through boardrooms, leaving finance leaders rethinking where and how they store their cash.

And while returns once ruled decision-making, today’s top priority is survival. The latest Depositor Priorities Survey from Ampersand Inc. confirms what many in finance have suspected: security and liquidity now trump yield.

Ampersand’s 2024 report, which surveyed 264 senior finance executives and treasury managers, paints a stark picture of depositors adapting to an unpredictable financial landscape.

With 90% of respondents expressing concern over deposit safety, corporate finance teams are taking action—whether that means moving cash to larger banks, diversifying holdings, or demanding more from their financial institutions.

The post-pandemic banking world is a different beast. The collapse of regional banks in 2023 rattled depositors, and confidence remains fragile.

The survey reveals that 70% of respondents have already adjusted their deposit strategies, with many migrating funds to perceived “safer” institutions. More than 40% say their banking experience would vastly improve if they had stronger assurances around liquidity and security.

This shift marks a fundamental reordering of corporate deposit priorities.

Where companies once focused on maximizing yield, today’s finance leaders are willing to trade returns for peace of mind. In fact, fully insured deposits now rank among the top three factors influencing where businesses store their cash.

One of the biggest hurdles for companies seeking safer deposit options is their existing banking relationships. More than 60% of respondents say they are limited in their ability to switch financial institutions due to loan agreements.

While banks use these agreements to secure long-term relationships, depositors increasingly view them as shackles that prevent them from responding to financial risk.

Even so, frustration is mounting. Nearly 90% of those affected by loan restrictions said they would consider moving their deposits if they could. Many finance leaders feel their hands are tied—forced to keep deposits with institutions they no longer fully trust simply to maintain access to credit.

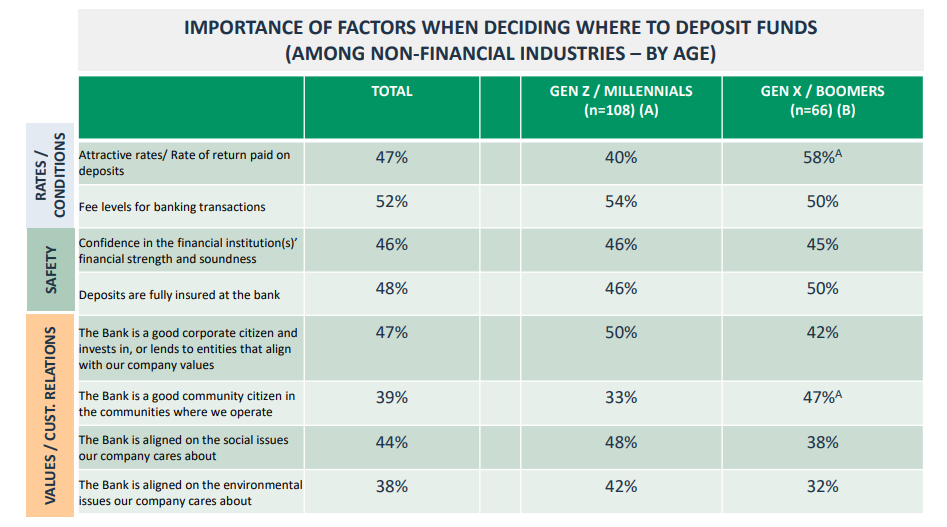

Beyond security concerns, a new force is shaping deposit decisions: corporate values.

The survey found that 88% of financial professionals believe demand for values-based banking products has surged, with nearly nine in ten depositors willing to accept lower returns in exchange for financial institutions that align with their ethical priorities.

For some, this means choosing banks that prioritize environmental, social, and governance (ESG) initiatives. For others, it’s about ensuring deposits support communities or sectors that align with their corporate mission.

While large banks still dominate when it comes to security, mid-sized institutions are gaining traction by offering bespoke solutions tailored to these priorities.

If there’s one clear takeaway, it’s that deposit management is no longer just a routine treasury function—it’s a strategic imperative. Finance leaders must navigate a complex landscape where risk, regulation, and reputation all factor into deposit decisions.

For corporate treasurers, the new rules are emerging fast: spread out funds to minimize exposure, demand full insurance where possible, and be prepared to renegotiate terms with financial institutions that no longer meet evolving needs.

With liquidity, safety, and values now the key drivers of deposit strategy, finance teams that fail to adapt may find themselves caught off guard in an era of financial uncertainty.